It Is like the slow aging course of that impacts each tangible and intangible property. Companies use depreciation to allocate the price of an asset over its helpful life, which helps match expenses with revenue era. To reduce these challenges, companies should base their salvage worth estimates on stable knowledge, consult trade specialists, and frequently evaluation financial assumptions.

Items Of Production Depreciation Technique

Predictive forecasting allows real-time updates and adjustments to salvage value estimates, serving to firms adapt shortly to modifications in market situations or asset efficiency. This technology allows companies to boost decision-making, cut back risks, and optimize asset management methods. In the manufacturing sector, salvage worth is integral for assessing the life expectancy and residual worth of kit and machinery.

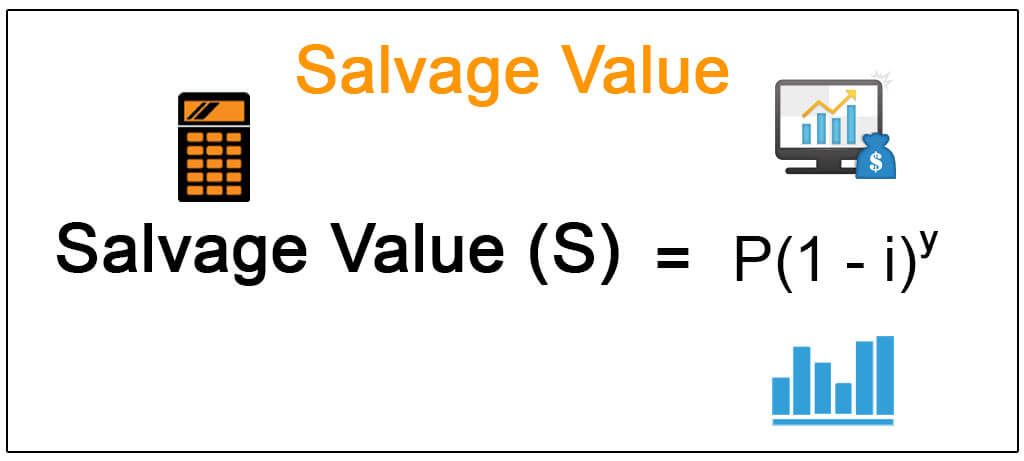

Salvage worth is the estimated worth of an asset on the finish of its useful life. It represents the quantity that an organization might promote the asset for after it has been absolutely depreciated. On the opposite hand, book worth is the worth of an asset because it seems on a company’s steadiness sheet.

By integrating monetary data and automating calculations, Deskera ERP ensures accuracy and consistency in determining salvage values throughout varied asset categories. Salvage worth is a critical concept in accounting and financial planning, representing the estimated residual worth of an asset at the end of its useful life. Subsequent, the annual depreciation could be calculated by subtracting the residual worth from the PP&E purchase price and dividing that quantity by the helpful life assumption. In some contexts, residual worth refers to the estimated value of the asset at the end of the lease or loan term, which is used to discover out the final fee or buyout price. In other contexts, residual worth is the worth of the asset at the finish of its life much less prices to get rid of the asset. In many circumstances, salvage worth may solely reflect the value of the asset on the end of its life with out consideration of promoting prices.

Influence On Investment Selections

Remember, accurate estimation of Salvage Worth requires a comprehensive evaluation of assorted components and considerations specific to the asset and its market. By understanding Salvage Value, businesses could make knowledgeable selections regarding asset management and financial planning. Incorporating salvage worth into danger management and financial planning enhances the precision of strategic choices and ensures sturdy asset administration. By accurately estimating salvage worth, businesses can better plan for asset retirement, stopping financial shortfalls as a outcome of sudden asset disposal prices. This technique depreciates the machine at its straight-line depreciation percentage times its remaining depreciable amount every year. In earlier years, an asset’s larger value leads to larger depreciation bills, which lower yearly.

Figuring Out The Helpful Life Of An Asset

- Conversely, rapidly obsolescing tools may see diminished salvage value.

- These calculations help manage budgets, streamline replacements, and plan for future investments.

- The idea helps in understanding how much worth an asset retains over time and is crucial in determining the annual depreciation bills for financial reporting.

- We can even outline the salvage worth as the amount that an asset is estimated to be price at the end of its helpful life.

All The Time doc your assumptions and reasoning when estimating salvage worth. Technological advances can considerably impression the willpower of salvage worth. As new and more efficient applied sciences emerge, older assets could turn into outdated and less desirable in the market. This can result in a decline in their salvage value as consumers prefer property with the latest technological capabilities.

They provide a handy approach to simplify advanced calculations for higher monetary planning. Sure, salvage value can change over time due to shifts in market circumstances, technological developments, and asset condition. Regular reassessment is crucial to ensure correct financial reporting and adaptableness in asset management strategies. There are a quantity of depreciation methods that companies can use to calculate the depreciation of an asset, every requiring particular assumptions concerning the salvage value.

Salvage Worth In Taxation And Accounting

The sum-of-the-years’ digits method is usually used for property with a higher productivity pattern in the early years and slower productiveness in later years. Firms estimate salvage value to discover out the amount to which an asset’s worth is depreciated over its helpful life. Depreciation is the allocation of an asset’s price over its anticipated lifespan. By subtracting the salvage worth from the unique cost, corporations can calculate the carrying worth of the asset after depreciation. This carrying value serves as an essential indicator of an asset’s remaining value on the company’s balance how to find salvage value of an asset sheet. Learn how to calculate the after-tax salvage value of enterprise belongings, a crucial consider monetary decision-making and correct monetary reporting.

Shifting on, let’s look by way of the small print of how the salvage worth can be utilized in depreciation calculations. Suppose a company spent $1 million purchasing equipment and instruments, which are expected to be helpful for 5 years after which be offered for $200k. Every 12 months, the depreciation expense is $10,000 and four years have passed, so the amassed depreciation so far is $40,000. Beneath straight-line depreciation, the asset’s value is lowered in equal increments per 12 months till reaching a residual worth of zero by the end of its useful life. The influence of the salvage (residual) value assumption on the annual depreciation of the asset is as follows. If the residual value assumption is set as zero, then the depreciation expense annually might be greater, and the tax benefits from depreciation might be fully maximized.

Accurately estimating the salvage value of your belongings is crucial for correct financial planning and asset administration. Our Salvage Value Calculator helps you identify the theoretical end-of-life worth of your assets and examine it with actual market data. Salvage value impacts monetary statements by influencing the calculation of depreciation expense, which is reported on the income statement. Accurately estimating salvage value ensures compliance with accounting requirements and provides a real reflection of asset value over time. The declining balance technique accelerates depreciation compared to https://www.kelleysbookkeeping.com/ the straight-line method, providing higher depreciation expenses within the initial years of an asset’s life.